In Credit Weekly Snapshot – April 2024

Our fixed income team provide their weekly snapshot of market events.

In Credit Weekly Snapshot – March 2024

Our fixed income team provide their weekly snapshot of market events.

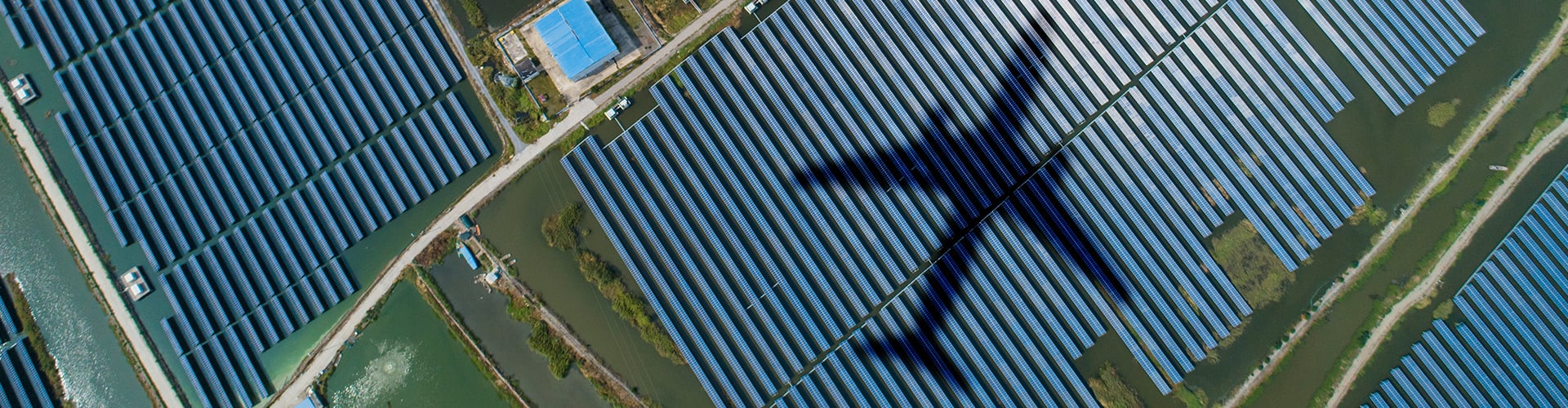

Chocks away! Airport passenger numbers – and financial metrics – recover

Increased numbers of fliers and supportive concession frameworks mean the industry retains a strong and steady credit trajectory.

The right locations

Looking for pockets of value in European real estate credits. We explain why select BBB- rated bonds look attractive and highlight datacentres and German residential as favoured subsectors.

European Utilities: as good as it gets…

Explaining why we’ve improved the European Utilities sector fundamental score from Neutral to Positive.

A unique lens on banks and net zero

How are financial institutions embracing the energy transition and managing climate change risks, and what are the opportunities presented by the decarbonisation process?

Through the windshield: rate hikes and borrowing costs for investment grade companies

The impact of rate hikes and borrowing costs on investment grade companies

Andrew Dewar

Andrew Dewar is a portfolio manager in the Investment Grade Credit team at Columbia Threadneedle Investments.

Residential and datacentres – European investment grade credit

Finding the right locations in European real estate credit. Any why residential and datacentres look attractive.

Under pressure – European real estate credit

Europe’s real estate sector has been under pressure since mid-2021. What’s behind its struggles and where can we find attractive credit opportunities?