As one of the world’s largest economies the US is a key focus for investors. With every country attempting to return to normality following the coronavirus pandemic, we are monitoring when US economic activity might get back on track, as well as other measures of “normality” such as entertainment and leisure, high street shopping, and schools reopening. The result is an index that measures progress toward a post-pandemic world.

Our Return to Normal index

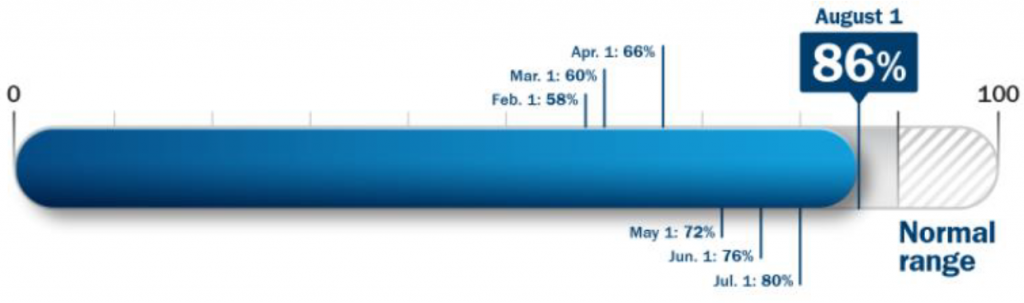

As the US continues its Covid-19 vaccination program, the Return to Normal Index measures human activity data relative to pre-pandemic levels. The index is constructed by our data scientists and fundamental analysts and tracks activities in the US, including travel, returning to work and school, brick-and-mortar shopping and eating out. By design, the index is focused on measuring components of daily life rather than economic indicators such as GDP growth. The percentage level will move closer to 100 as daily life normalises, and our analysts will update it on a regular basis.

What has changed?

The Return to Normal Index is now 86%, but the delta variant is very much on our minds and the minds of health authorities. It’s much more transmissible than the original strain of SARS-CoV 2 and other variants, meaning that one infected person can make even more people sick. As a result, daily case counts have been rising — especially in areas with lower vaccination rates.

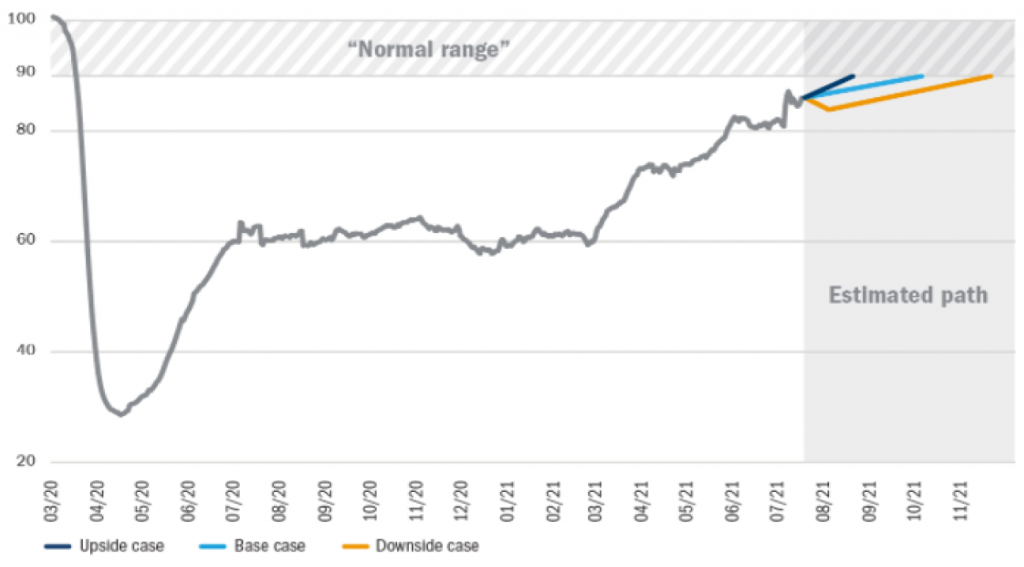

Vaccines have been proven to be very effective at preventing Covid hospitalisations — even against the delta variant — but even for those who have been vaccinated, there’s still a risk of contracting the virus (these are called breakthrough infections). Because of higher infection rates, we are seeing health authorities, local leaders and even some individuals exercise more caution, so we’ve pushed out our base case of an expected return to normal to late September. This revised projection is based on evolving data that may impact return to school and return to work, and we are watching it closely.

Figure 1: The Return to Normal Index tracks activity compared with pre-pandemic levels as we progress to post-Covid life

Source: Columbia Threadneedle Investments, 1 August 2021

What are we monitoring, and where is it at?

We are analysing the time people spend engaging in a broad set of activities outside their homes (Figure 2). The index components have implications for economic growth, but the primary objective is to monitor how close or far we are to returning to normal life.

Figure 2: Tracking inputs

Overall, our index suggests that we’re still 14% below pre-Covid activity levels, but some components of our index have already returned to normal levels. Activity for bricks-and-mortar spending and return to school are now into our normal range — spending gains are driven by pent-up demand, and school data has shown that there are plans for in-person schooling. Both numbers may fluctuate — spending may fall a bit as demand normalises; in-person schooling may fall if US districts change their plans in response to infection and hospitalisation rates. Activity numbers for some index components won’t return to where they were before Covid. Some changes in behaviour, such as working from home, are likely to stay with us for an extended period and because of this, activities such as business travel might take longer to reach the 90% threshold or pre-Covid levels.

What could drive change?

Because of the rising number of delta variant infections, we’re closely monitoring: the data on vaccine efficacy and the need for boosters; the public health response in terms of masking/restrictions; employer policies on return to office; and the emergence of new variants. The data on the delta variant is evolving, and if we see a large uptick in hospitalisations, our return to normal levels of activity could be impeded. We will likely learn a lot more in the upcoming weeks about the transmissibility of the delta variant, vaccine efficacy and whether people will need boosters. These datapoints could change our base case or downside case.

Figure 3: The Return to Normal Index over time – level as of 1 August 2021: 86%

Source: Columbia Threadneedle Investments, 1 August 2021

This index continues to provide a framework as we analyse companies. It’s a roadmap for what normal activity might look like after Covid and how long it will take to get there. The information allows us to test a company’s own assumptions and make adjustments in our views as needed.

For investors, the Columbia Threadneedle Return to Normal Index can act the same way: it’s an additional input to consider as they research their individual asset allocation and portfolio decisions.

Understanding where we are on the path to normal life continues to be a critical question in 2021. This data input can help inform investors’ asset allocation decisions and set expectations on market activity.