Crises typically accelerate pre-existing trends: the sharing economy blossomed after the global financial crisis and there was a wave of lasting innovation after the dotcom era. Likewise, the post-Covid-19 era will be defined by a combination of new technologies and companies enabling people to work, relax and eat “remotely” (at home in particular in the short term), and the shift from offline to online across all sectors and demographics.

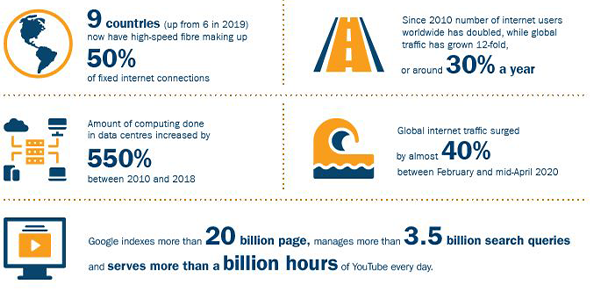

Thus, Covid-19 is accelerating the need for digital transformation and digital should be considered an infrastructure sector in its own right. In fact, as can be seen in Figure 1 the user numbers and growth it has seen over the past decade are phenomenal.

Future projections also indicate exponential growth in demand for network services and data centres:

- An increase from 7% to 25%-30% in people working from home on multiple days a week in the US1

- Global internet traffic expected to double by 2022 to 4.2 zettabytes a year (4.2 trillion gigabytes)2

- Nearly two-thirds of the global population will have internet access by 2023, with 5.3 billion internet users in total, up from 3.9 billion (51% of the global population) in 2018. The number of devices connected to IP networks will be more than three times the global population by 2023, up from 2.4 networked devices per capita in 2018. This equates to 29.3 billion networked devices by 2023, up from 18.4 billion in 20183

- Between 2019 and 2022 traffic from internet video is expected to more than double to 2.9 zettabytes, while online gaming is projected to quadruple to 180 exabytes.4

What does digital infrastructure include?

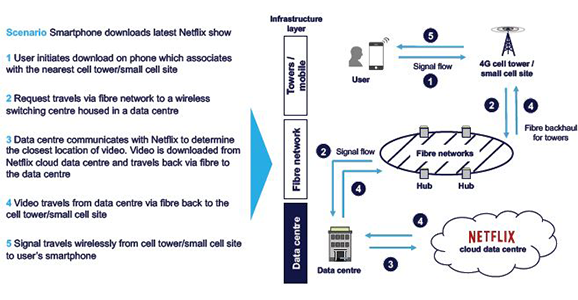

Digital infrastructure assets include everything from the towers that carry data traffic across mobile networks, to the fibre optic networks required to connect businesses and homes, and data centres, which organisations use to house their critical networks of computer and storage resources. This infrastructure delivers what is now considered to be critical services for the continuing function of modern economies enabling economic growth and productivity

Source: OECD broadband statistics update, March 2020/Science, Recalibrating global data center energy-use estimates, 27 February 2020/Google, Google Data centers: sustainability, innovation and transparency, 7 April 2020.

Increased demand for data, and data on-the-move in particular, is behind the continued growth in mobile towers/masts that has burgeoned over the past decade. The more data traffic means operators need to build more towers or hang ever more equipment on existing towers. Meanwhile, the growth in online gaming and streaming services such as Netflix, Amazon Prime and Disney + is behind the growth of fibre in the home, as is the recent upsurge in the number of people working from home. Although the B2B market is smaller and less diverse, it was a growing area – however, perhaps a shift away from office working could throw some doubt over its immediate prospects.

Data centres, meanwhile, have been at the heart of business for the past 30 years, and now more than ever they provide the critical infrastructure that supports remote working, as well as education and TV streaming. Additional capacity and connectivity are predicted longer-term to support this accelerating structural shift. The EU believes data volume will rise by five times between 2018-25.5 But the burgeoning digital economy requires a different type of data centre, one that enables seamless interconnection and the global and rapid exchange of data traffic. These carrierneutral locations are where the major mobile, content and cloud providers can co-exist, or co-locate (Figure 2). Now their digital transactions can take place in the same data centre and at high speed.

Source: Solon, 2020

Beyond this there is now the migration of information into the cloud. This involve massive amounts of data and requires equivalent storage capacity, known as “hyperscale”. This is what Google, Amazon, Microsoft and other digital behemoths are building.

Suffice to say, all of this technology demands security, reliability and resilience. It must also service everyone. Modern businesses, digital customers, people working from home – geography is no longer a hinderance to what you do or where you do it, but connectivity can be. People in rural areas who are now required to work from home need fast and reliable fibre broadband just as much as those in cities and towns. If anything, Covid-19 makes even more compelling the case for high-security, high-capacity, highly resilient and broadreaching digital infrastructure – and to maintain smooth operations, the need for investment is more important than ever.

Suffice to say, all of this technology demands security, reliability and resilience. It must also service everyone. Modern businesses, digital customers, people working from home – geography is no longer a hinderance to what you do or where you do it, but connectivity can be. People in rural areas who are now required to work from home need fast and reliable fibre broadband just as much as those in cities and towns. If anything, Covid-19 makes even more compelling the case for high-security, high-capacity, highly resilient and broadreaching digital infrastructure – and to maintain smooth operations, the need for investment is more important than ever.

Investment opportunity

So the demand is beyond doubt, and the infrastructure elements are in place – but as it stands the latter is simply not capable of delivering the former. The rapid pace of change of this sector of the past 20 or so years means that networks created in the last century are no longer fit for purpose.

Also, although as previously mentioned nine countries now have high-speed fibre making up 50% or more of their fixed internet connections, across the 37 countries studied by the OECD the share of fibre in total broadband had only risen to 27% as of June 2019, up from 24% a year earlier.6 This reflects a wide gap between different countries in rolling out fibre.

The required transformation requires huge amounts of capital, creating opportunities for investors. Prior to the pandemic, the most recent analysis of 5G spending by Greensill, a non-bank provider of working capital, had the total bill for the 5G rollout across the world as likely to top $2.7 trillion by the end of 2020 alone.7

This will require a mix of public and private funding – a recent survey of infrastructure investors by M&E Global Inc found that 32.4% thought government support was key to unblocking digital infrastructure investment.8 But despite these costs, investors want to get involved: the same survey found that more than half of respondents think digital infrastructure is key to re-booting economies in a post-Covid-19 world (and 63% are already actively involved in financing/delivery of digital infrastructure), while 63.6% think the benefits of digital infrastructure outweigh the risks.

After all, these are long-life assets providing essential services, with strong cashflows (customers who enter into recurring contracts) with the ability to potentially deliver long-term growth in a down or flat market, as is the case now. This is key for institutional and other investors.

Columbia Threadneedle Investment’s European Sustainable Infrastructure Fund announced on 6 May 2020 the acquisition of a majority stake in the Lefdal Mine Datacenter (see /en/media-centre/). This is a unique “green” data centre based in an underground mine in Norway, which uses cold sea water from an adjacent fjord for cooling and renewable energy to power its operations. Rittal, a subsidiary of the German industrial family business, Friedhelm Loh Group, remained a minority shareholder post-transaction.

The majority stake was acquired from a consortium of local shareholders in a transaction which, together with Rittal, facilitates further investment and capacity expansion. Operational since 2017, the facility boasts 75 underground halls with data centre containers parked in former mine workings that are accessed by a road system. The centre benefits from high-density data capacity and has a market-leading total cost of operation which is attractive to clients with high-performance computing workloads, hyperscalers, and for customers looking for colocation solutions.

An opportunity for serious investment into sustainability

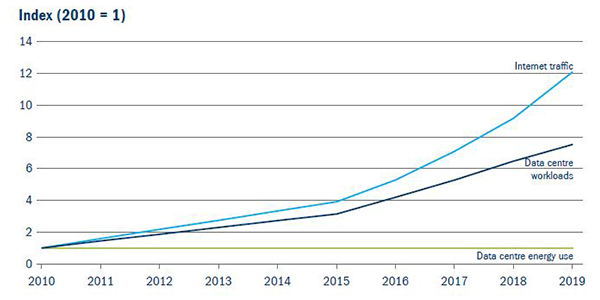

What digital infrastructure investing also promises is the opportunity for significant investment in sustainability. Greater connectivity and the huge increase in data use, traffic and streaming is not without environmental consequence: for every bit of data that travels the network from data centres to end-users, another five bits of data are transmitted within and among data centres, all of which use energy (mostly electricity). It is estimated that energy demand from data centres and transmission networks accounts for around 1% of global electricity use in 2019.9

However, the growth in demand currently continues to be offset by efficiency improvements in servers and data centre infrastructure (Figure 3). Given future projections of demand growth, data centres formed on a basis of sustainability are a necessity not a luxury.

Source: International Energy Agency, June 2020.

Companies are actively integrating sustainability factors into the business decisions they are making about their digital infrastructure – and shareholders, of course, have the ability to influence this, as well as how firms source the required energy. Google, for example, has matched 100% of the energy consumed in its data centres through renewable energy purchases since 2017, and is now the world’s largest buyer of renewable energy – last year it bought $2 billionworth, which is more than any other business.10 Apple claims a similar 100% matching figure.11 Microsoft, meanwhile, announced in January its intention to be carbon negative by 2030, and it currently sources 60% of power for its data centres from renewable sources. It has set a goal to get to 100% by 2025 from a mixture of wind and, increasingly, solar.12 All in all, ICT companies account for about half of global corporate renewables procurement in the past five years.13

A further vital part of the sustainability conversation comes with the data centres themselves, and their location and operation. Hyperscale, or very large, data centres are far more energy efficient than smaller, local servers. The increasing shift towards them is evident in the flat line of energy consumption despite increased use. Google is increasing its network of global hyperscale facilities and plans to invest $3 billion in a European expansion alone.14 And the construction of these hubs will, according to the firm, minimise the use of resources such as water and energy, with fully integrated and bespoke cooling systems dictated by the centre’s location, all of which seek the highest performance and optimal cost.

And the construction of these hubs will, according to the firm, minimise the use of resources such as water and energy, with fully integrated and bespoke cooling systems dictated by the centre’s location, all of which seek the highest performance and optimal cost.

Site selection for data centres is also key, and not just for Google. Microsoft, for example, is heavily influenced by environmental factors in its selection. One of its centres in Sweden was selected due to a highly reliable electricity grid, meaning the site would not have to rely on diesel backup power.15

All of which is part of an increasing shift for corporations to take greater ownership of their emissions, which runs concurrent with the same desire from shareholders. The sustainability implications of data centre choices for firms, for data storage and the shift to the cloud, are now an integral part of the conversation. In Microsoft’s Q1 2020 CIO Survey, 17% of CIOs said that a data centre’s use of renewable energy was a major or determining factor in their decision when choosing a provider, which it noted was “not an insignificant percentage”.

While such hyperscalers are actively integrating sustainability into their investment decisions around digital infrastructure, private investors have not yet been as progressive – but that doesn’t mean there aren’t opportunities for infrastructure investors, particularly in Europe.

For example, such sustainability considerations were key determinants of the decision by the Columbia Threadneedle European Sustainable Infrastructure Fund to invest in Lefdal, a Norwegian data centre, earlier this year.

Energy efficiency is a key factor when determining the sustainability characteristics of a data centre. This efficiency is commonly measured by a PUE ratio (Power Usage Effectiveness). This metric shows how much power a data centre consumes in addition to the installed servers, and cooling is the most significant factor. For instance, a PUE of 1.7 means that 70% of the power used in the data centre is used for cooling and other things, in addition to keeping the servers in operation. Lefdal has a PUE guarantee ranging from 1.10-1.15 depending on technical requirements. This is industry leading and possible due to using cold water as a cooling resource independent from weather conditions. In addition, all energy consumed by Lefdal is from renewable sources (hydro and wind), thus equating to zero CO2 emissions.16

Digital infrastructure should understandably be assessed on its environmental characteristics, but don’t underestimate the significant social impact. It contributes positively to productivity and economic growth, with the World Economic Forum estimating that the combined global value of digital transformation to society and industry will exceed $100 trillion by 2025.17 All these benefits can be appropriately mapped to the United Nations’ Sustainable Development Goals (SDGs). Investment in technology enhances social and development outcomes in a country through several channels: internet access and enhanced telephone communication can improve access to information on employment and education, which will increase the chances that people can lift themselves out of poverty (SDG 1); digital infrastructure and Internet of Things technologies can stimulate agricultural sustainability and improve food security (SDG 2); and telecommunication can aid income inequality by connecting remote areas with cities and providing less developed countries and rural communities with work opportunities and free access to knowledge (SDG 10).

Beyond the primary implications for greater sustainability, the technological advances could have subsequent or secondary impacts that can help improve things environmentally. So, not only does more efficient data usage means less energy use, but better quality, more reliable and more secure data infrastructure means, for example, that video conferences become the norm rather than just a pandemic necessity. This could mean less travel by both air and road.

If the Covid-19 pandemic has shown anything, it is that what might have previously been considered inconceivable is now highly practicable, cost-efficient, and environmentally sound. The future of work promises to be quite different from the past, and digital infrastructure has a vital role to play in this.